Demand of the Ethylene is Continuing Increasing by 35 Per Year

In the chapter on olefms plants, in the section on propylene, a route to making propylene involved butene-2. In this process, called metathesis, ethylene and butene-1 are passed over a catalyst, and the atoms do a musical chair routine. When the music stops, the result is propylene. The conversion of ethylene to propylene is an attraction when the growth rate of ethylene demand is not keeping up with propylene. Then the olefins plants produce an unbalanced product slate, and producers wish they had an on-purpose propylene scheme instead of just a coproduct process. The ethylene/butene-2 metathesis process is attractive as long as the supply of butylenes holds out. Refineries are big consumers of these olefins in their alkylation plants, and so metathesis process has, in effect, to buy butylene stream away from the gasoline blending pool. [Pg.96]

Propylene is a coproduct of steam cracking, the yield of which accounts for nearly half of the ethylene yield. Currently, propylene demand exceeds ethylene demand and steam cracking cannot keep up with the required propylene/ethylene balance. To close the gap, an increase in propylene production from the FCC process is needed. [Pg.82]

The outlook for ethylene demand in the next decade is one of continued strong growth. Based on our discussions with several ethylene producing and consuming companies, we feel that the projections shown in Table I, which presents estimated annual ethylene demands for the 1970-80 period, are realistic and if anything, somewhat conservative. [Pg.166]

In the United States ethylene demand is expected to go from 15.7 billion pounds in 1970 to over 35 billion pounds in 1980—a compounded annual growth rate of about 8%%. In Western Europe annual demand will grow by some 17 billion pounds between 1970 and 1980 from the... [Pg.166]

The current decade s outlook is for continued strong worldwide growth in ethylene demand. Total new plant construction for the 1970 s... [Pg.191]

Phillips, Qatar Petroleum, and Total is investing in a 1.3 mmt/year cracker in Ras Laffan, Qatar. However, because ethane production is linked to gas and oil production, the Middle East ethane supply will be able to meet only around 17 percent of global ethylene demand, which is expected to be 135 mmt/year by 2010 (Fig. 7.6). [Pg.86]

However, while stranded gas supplies are essentially unlimited, access to low-cost ethane for ethylene plants does have limits. Ethane supplies are developed only with natural gas or crude oil production regional consumption and LNG demand will set the demand for natural gas, while OPEC will determine crude oil output. We estimate that the available ethane in the Middle East could only cover about 40 percent of all new worldwide ethylene demand through 2010, by which date the region s ethylene market share would reach 17 percent. Even if stranded natural gas and ethane in other locations are put to use, they will be far from covering all demand growth, and chemical producers will need to continue to rely on the established types of feedstock, while at the same time considering alternatives (Fig. 16.5). [Pg.207]

Likewise, Dow Chemical Company, instituted a major corporate restructuring in 2009 which included the shutdown of as many as 20 manufacturing plants, including an ethylene cracker in Louisiana, and ethylene derivative facilities in Louisiana and Texas. The closings reduced Dow s ethylene demand by... [Pg.39]

Burke and Miller (8) published in 1965 a two-part report on ethylene which provides an overview of the world ethylene producers, plants, capacities, feedstocks, and economics. Much of their information is augmented and updated by an economic study published by Freiling, Huson, and Summerville (22) of Lummus. Growth in ethylene demand is ex-... [Pg.165]

The general effect, then, as a refiner s ethylene demands increase, is a severity increase on a given feedstock with a resulting decrease in propylene production. At some point he will have to build new facilities. When the new plant is built, the design capacity will be undoubtedly greater than his current needs, and his new unit will be placed on stream —possibly at 70-75% of design ethylene capacity. The old unit would presumably be moth-balled until such time as the new facilities cannot meet production demands. [Pg.167]

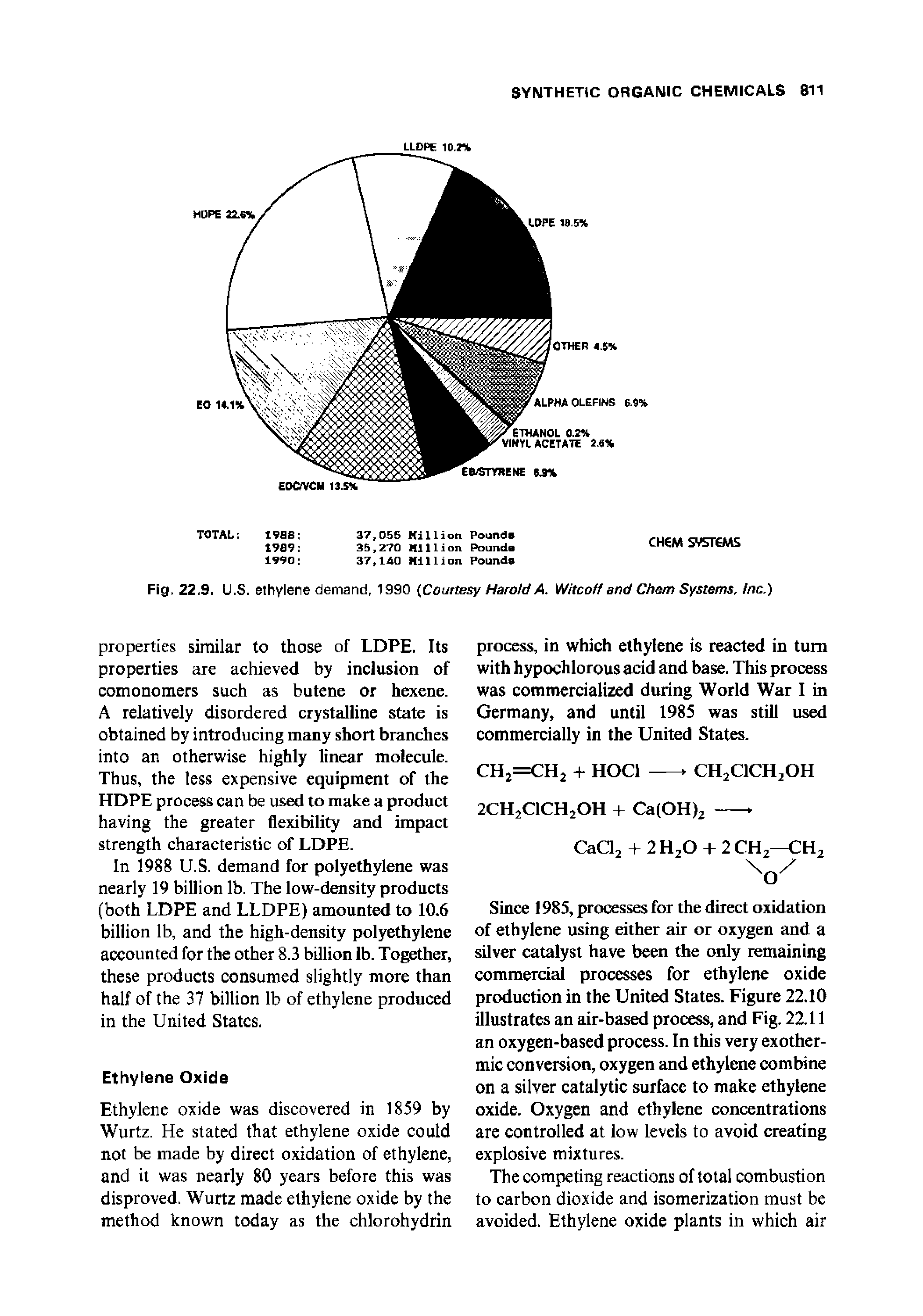

| Fig. 22.9. U.S. ethylene demand, 1990 (Courtssy Harold A. Wdcoff and Cham Systems. Inc.)... |  |

Source: https://chempedia.info/info/ethylene_demand/

0 Response to "Demand of the Ethylene is Continuing Increasing by 35 Per Year"

Post a Comment